Cryptocurrency Staking – Detailed Guide for 2025

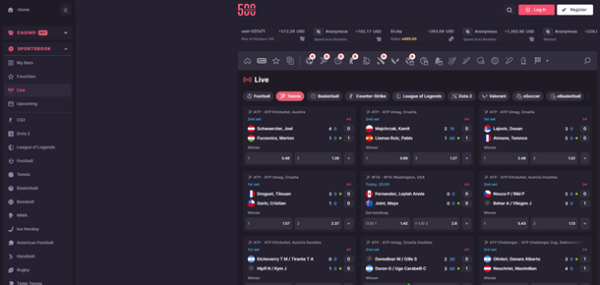

Investors are flocking the digital currency world, hoping to get a share of the growing sector. If you are an agile cryptocurrency investor, you must know the ins and outs of cryptocurrency staking. It’s one of the safest processes investors can use to earn interest on their hard-earned money. Cryptocurrency is becoming the easiest and speediest form of payment used by different merchants worldwide. Bettors can now use cryptocurrencies like Bitcoin to fund their accounts and wager on various gambling activities.

In this detailed guide, we cover the pros and cons and how to benefit from cryptocurrency staking and crypto sports betting.

Table of Contents

- 1 A 2025 Detailed Guide to Cryptocurrency Staking

- 2 How Does Cryptocurrency Staking Work?

- 3 Is Cryptocurrency Staking Worth It?

- 4 FAQ

- 4.1 Can anyone take part in cryptocurrency staking?

- 4.2 How does one stake their cryptocurrency?

- 4.3 What cryptocurrencies can I stake?

- 4.4 Which are the best staking platforms that I can use for cryptocurrency staking?

- 4.5 Why should I stake on the stable coins?

- 4.6 How long does the staking period last?

- 4.7 Can I withdraw my tokens during the staking period?

- 4.8 What is the staking percentage for my cryptocurrency tokens?

- 4.9 What are the risks of cryptocurrency staking?

- 4.10 What key factors should I consider when checking for the most profitable staking digital coins?

- 5 Staking Vs. Mining

- 6 What Cryptocurrency Can I Stake?

- 7 The Best Cryptocurrency Staking Platforms

- 8 How to Pick the Best Cryptocurrency Staking Platform

- 9 Cryptocurrency Staking Pros

- 10 Cryptocurrency Staking Cons

- 11 Risks of Cryptocurrency Staking

- 12 The Future of Cryptocurrency Staking

- 13 Conclusion

A 2025 Detailed Guide to Cryptocurrency Staking

What is Cryptocurrency Staking?

What is cryptocurrency staking? This is a process where the cryptocurrency tokens are placed into working. The process, in turn, generates the value of tokens. Cryptocurrency is also referred to as winning bags for the HODL. The process involves committing the cryptocurrency assets to the best Blockchain network.

When investors commit their tokens to the Blockchain, their Blockchain transactions get the needed validation. If more staking is done, the Blockchain becomes more robust. When you improve the network’s reliability through staking, the network is willing to reward you with coins for staking.

So what entails cryptocurrency staking? You pledge to help with the PoS (proof-of-stake) Blockchain consensus mechanism when staking your digital coins. The system has validators. The validators with enough staked assets will validate the Blockchain transactions, generating rewards for the cryptocurrency owner.

As a cryptocurrency investor, you can either stake yourself or get someone to do the staking for you. If you decide to do it yourself, you will need a validator code. You can also contribute to a stake pool, and a third party will complete the service then distribute the rewards accordingly.

Staking is essential if you want to gain more coins from your already hard-earned cryptocurrency. The next question you might have is how does staking work? And is it safe?

How Does Cryptocurrency Staking Work?

Cryptocurrency staking involves a passive activity and earning passive income. This passive income is earned regardless of whether you stake through an exchange service or a pool. As an investor, you are only required to lock the coins.

When you decide to participate in cryptocurrency staking, the Blockchain validators will use the stake holdings to form new blocks inside the blockchain network. Therefore the more digital coins you stake as an investor, the higher the chances of a specific token being selected. The written information on the new block and the staked and locked tokens will validate the information.

When staking your tokens, you will need to lock the tokens for a certain period ranging from 30 days, months, and even one year. In some instances, you can stake your tokens for a longer period. The period of staking determines the Annual Percentage Yield (APY). The Annual Percentage Yield is much higher for investors who stake their tokens for an extended period.

Investors should know that they cannot withdraw the tokens when staking their tokens. Cryptocurrency staking isn’t possible with any proof-of-work blockchain unless on special exchange platforms. These blockchains instead depend on mathematical puzzles when rewarding validators. The proof of stake digital currencies rely on staking as secure means of validating Blockchain transactions.

Is Cryptocurrency Staking Worth It?

Investing in cryptocurrency is very volatile; one wrong move and you could end up losing your hard-earned money. Picking the crypto staking strategy will determine whether staking is worth it or not. There are two main types of cryptocurrency investors. The first is the passive investor, who leaves his tokens in the wallet, waiting for a positive shift in the market. In contrast, the second variety is the active investor who frequently trades his tokens with other coins and wants daily access to his tokens. If you are a passive investor, then cryptocurrency staking will benefit you.

Passive investors don’t need to wait for an increase in the value of their tokens to earn a reward. Instead, they can use staking. You get to put your cryptocurrency to work instead of laying idle in your cryptocurrency wallet. Active investors will not benefit from staking since they want frequent and immediate access to their tokens, which isn’t possible with staking.

Active investors

Luckily, if you are an active investor, you can choose to stake a portion of your tokens and continue actively trading with the remaining portion. It’s a smart move if you are a versatile investor who doesn’t like putting all your eggs in one basket.

Staking rewards work in the same way as stock dividend payments. They are both passive income sources, which don’t require the owner to do anything except own the right tokens at the most optimal time. The more staking period you opt for your tokens, the higher the potential profit you are likely to get. The final potential profit is based on the compound interest.

However, unlike the stock dividend payments, you have to consider important key variables when staking your cryptocurrency. One of these factors is that the proof of stake (PoS) digital coins can easily determine how much staking reward you will get as an investor at the end of your staking. Learning about all these factors will help you make the best decision in cryptocurrency staking and come up with the best staking strategy.

To ensure you greatly benefit from staking your tokens, you need to analyze the size of the reward, the number of tokens being staked, and the size of the staking pool. The fiat currency is another key factor to consider. While there are many key variables to consider, fully researching and understanding them is essential.

FAQ

Can anyone take part in cryptocurrency staking?

While anyone can participate in cryptocurrency staking, there are some minimum requirements investors need to meet based on their staking needs. One of the key requirements is having a minimum number of coins in your wallet; for instance, in ETH 2, staking users must have a minimum of 32 ETH.

How does one stake their cryptocurrency?

If you want to stake your coins, you can use the following key options:

- Using a cryptocurrency exchange platform that offers staking services.

- Using a wallet

- Staking on your own

- DeFi staking

You can stake the coins on your own or higher third-party services to do staking for you for the above options.

What cryptocurrencies can I stake?

Below is a list of some of the popular cryptocurrencies you can stake:

- Ethereum

- Tezos

- Solana

- Cardano

- Polkadot

- Icon (ICX)

- Bitcoin (BTC)

- Polkadot (DOT)

- Polygon (MATIC)

- Chainlink (LINK)

Which are the best staking platforms that I can use for cryptocurrency staking?

The best cryptocurrency exchange platforms offering staking services are:

- Zipmex

- Kraken

- Gemini

- Coinbase

- Binance

Why should I stake on the stable coins?

Staking stable coins offers investors a chance to hold their funds in a low-interest environment while earning yields safe from market volatility. Some of the top stable coins you can consider are:

- USDC: 3.23% in OKEx, 0.15% in Coinbase and 3.49% in Binance

- BUSD: 3.59% in Binance

- DAI: 4.12% in OKEx and 2% in Coinbase

- USDT: up to 13.93% in OKEx and 5.47% in Binance

How long does the staking period last?

There is no definite or standard staking period. Different staking platforms have other staking periods starting from days to even years. Investors have the option of choosing their most preferred staking period based on their staking needs.

Can I withdraw my tokens during the staking period?

Investors cannot access the tokens when they participate in cryptocurrency staking. The process is similar to having a locked-savings account. Therefore, you can only access your tokens when the staking period ends. Trying to withdraw or use the tokens during the staking period increases the chances of losing their staking rewards.

What is the staking percentage for my cryptocurrency tokens?

The staking percentage varies from one coin to another and from one staking platform to another.

What are the risks of cryptocurrency staking?

Just like any other investment, there are risks involved with cryptocurrency staking. Below are the risks of using cryptocurrency staking:

- Cryptocurrency is volatile

- During lock periods, investors can’t access the tokens

- Beware of slashing

- You might have to pay some fees

What key factors should I consider when checking for the most profitable staking digital coins?

When checking for the most profitable coins to stake, you should consider the following factors:

- The token size you want to stake

- The staking pool size

- The size of the reward

Staking Vs. Mining

Is staking similar to cryptocurrency mining? These two common blockchain activities are very different. The main difference between these two activities is based on the underlying blockchain consensus mechanisms which validate these transactions. Cryptocurrency mining is used for PoW (proof of work), while staking is used for PoS (proof of stake).

Mining requires specialized mining hardware, which consumes a lot of energy, hence considered environmentally unfriendly. Staking, on the other hand, is more ecologically sustainable. In cryptocurrency mining, the miners need to solve complex mathematical puzzles while staking nodes validate new blocks by locking their tokens.

What Cryptocurrency Can I Stake?

Digital currencies have gained immense global popularity like the online gambling industry. New digital currencies are being launched, set to meet the various financial needs of consumers. However, with the main options to pick from, not every token is suitable for staking.

Investors staking with natively PoS tokens will need to do so on specialized exchange platforms. Nevertheless, some digital coins are more beneficial to investors regarding cryptocurrency staking. Next, we want to cover the top digital currencies you should prioritize when considering cryptocurrency staking.

-

Bitcoin (BTC)

Bitcoin is one of the most popular and legendary digital coins in the cryptocurrency sector. It is the first digital currency and has the largest market capitalization. Even though Bitcoin isn’t built to work with the proof of stake consensus mechanism, investors can still stake their bitcoins tokens. To stake your bitcoin tokens, you will have to use cryptocurrency staking platforms, where the token will be used to protocols while generating rewards.

Due to immense popularity, it’s easy to find reliable cryptocurrencies staking platforms that accept bitcoins for your taking needs. Before choosing any staking platform, it’s important to consider some key factors. In our guide, we will cover a detailed review of various cryptocurrencies staking platforms you can consider.

-

Ethereum (ETH)

Ethereum (ETH) is one of the best staking digital coins. It is the second most popular and widely traded cryptocurrency after bitcoin. There are specific requirements that investors need to meet for them to take part in Ethereum staking. The Ethereum 2.0 upgrade gives investors a chance to stake their tokens as long as they own a minimum of 32 ETH.

ETH is considered one of the best digital currencies to stake because it possesses the largest ecosystem of dApps (decentralized applications). Additionally, ETH has a crucial impact on DeFi (decentralized finance).

-

Polkadot (DOT)

Polkadot (DOT) is one of the best digital currencies for staking because it uses the Proof of Stake consensus protocol. The blockchain network uses the PoS (Proof ofStake) as its default consensus protocol; hence one can easily control it during any cryptocurrency staking process. Unlike the other PoS blockchain networks, Polkadot (DOT utilizes a unique variation of the Proof of Stake consensus protocol known as the NPS system.

With the NPS system, nominators can back validators using their stake. The backing up process is considered a sign of the validators’ trust and reliability. The validation enhances the credibility of Polkadot (DOT) staking as an investment option in cryptocurrency.

-

Polygon (MATIC)

Like ETH and DOT, Polygon (MATIC) uses a PoS (Proof of Stake) sidechain as its main chain. The MATIC POS side chain is part of the Ethereum Blockchain. Participants can stake their Polygon tokens and validate the transactions on the blockchain network. They can also vote on blockchain network upgrades. The voting process by participants brings an additional value to the cryptocurrency token. Polygon (MATIC) is a solid option for cryptocurrency staking with the voting process.

-

Chainlink (LINK)

Every cryptocurrency in the market aims to target a specific need or consumers. Chainlink (LINK) digital currency targets smart contractors. The main goal of digital currency is to incentivize an international network of computers and provide real-time data and information to smart contractors. It specifically targets smart contractors at the top of the LINK blockchain network.

However, the Chainlink (LINK) digital currency operates under the Proof of Stake (PoS) blockchain consensus mechanism. With this blockchain consensus mechanism, node operators stake their coins. When staking their coins, the transactions are validated hence sourcing the blockchain network. The PoS blockchain consensus mechanism used by LINK makes it one of the best cryptocurrencies for staking.

-

Tezos (XTZ)

Tezos (XTZ) is one of the top digital coins taking the cryptocurrency industry by storm despite being less than five years in the industry. The cryptocurrency was introduced into the market in 2018. It made a lot of stir and excitement in the market for having an ICO of more than $230 million, which is considered one of the biggest initial coin offerings in cryptocurrency history.

Tezos (XTZ) uses an improvised version of the PoS (Proof of Stake) sidechain, which is called PLoS (liquid Proof of Stake). XTZ is the native currency of Tezos, and the Tezos (XTZ) staking process is called baking. Investors (bakers) are rewarded with the native coins. The baking process also penalizes any malicious investors by having their stakes confiscated.

Investors who want to become bakers must have a minimum of 8,000 XTZ coins and run on a full node. However, investors with a smaller reserve of XTZ coins can still stake using third-party services. The annual percentage on the Tezos (XTZ) stake ranges from 5%to 6%.

-

Algorand (ALGO)

The main aim of Algorand (ALGO) is to enable clients to enjoy low-cost payments across all platforms. Algorand (ALGO) uses the Proof of Stake (PoS) blockchain consensus mechanism; therefore, it requires stakes for transaction security and processing. Just like Tezos (XTZ), Algorand (ALGO) uses a unique Proof of Stake protocol known as PPOs (pure proof of stake), and stakes are also required to operate on full nodes.

Investors can also use third-party services that support ALGO staking. The staking rewards of Algorand (ALGO) range from 5% to 10% annually. The rewards are highly determined by the staking platform used by the investor.

Now that you know the best cryptocurrencies to stake on, we want to take you through the best staking platforms that will give you the highest rewards.

-

Icon (ICX)

Icon (ICX) is a Korean digital currency. The complex blockchain project from Korea offers investors a chance to stake. However, unlike most other digital coins in our list, Icon (ICX) uses the DPoS (delegated proof of stake) consensus algorithm. With the Icon (ICX) model, a specific number of users verify transactions and find new blocks, while the other users allocate their tokens to these entities.

ICX is the native token of Icon. The annual staking rewards given by Icon range from 6% to 36% annually.

The Best Cryptocurrency Staking Platforms

Cryptocurrency staking has gained popularity among cryptocurrency enthusiasts. Hence the emergence of many cryptocurrency staking platforms. Below is a list of the best platforms to consider for cryptocurrency staking:

Zipmex

Zipmex is a cryptocurrency exchange platform. It solely focuses on providing institutional and retail investors with a platform to invest in various cryptocurrency tokens. The Zipmex exchange initially began as a crypto spot market exchange; however, it has evolved and even included a cryptocurrency staking platform called ZipLock.

The Zipmex ZipLock staking program allows cryptocurrency investors to stake their tokens on the platforms successfully. Unfortunately, the service is limited to Singapore, Australia, Indonesia, and Thailand.

Kraken

Kraken is one of the most reliable cryptocurrency exchange platforms. Apart from exchanging their tokens for other tokens available on the platform, Kraken allows users to stake their tokens successfully. It is one of the oldest and most reliable cryptocurrency exchange platforms. It also supports various cryptocurrency tokens.

Kraken is very popular among newcomers and cryptocurrency beginners because of its simple user interface. It also features a wide collection of education resources that educate individuals on the various cryptocurrency assets available on the platform. With educational resources, users can make more informed cryptocurrency investing decisions.

Kraken has the following staking percentages:

Gemini

The platform was launched in 2015 as a cryptocurrency exchange platform. Gemini focuses on providing the best cryptocurrency exchange services to professional cryptocurrency traders and beginners. Investors have different options for buying, selling, and even trading digital coins on the platforms.

Gemini joined other top cryptocurrency exchange platforms by starting a digital currency staking service. Investors can stake their tokens and get rewards when the staking period ends. One of the key features of the exchange platform is the top-tier security features and a wide variety of tools for more advanced trading capabilities.

Binance Staking

Binance is the largest digital currency exchange platform by its trading volume. Hence, Binance comes at the top of the most reliable cryptocurrency trading platforms list. Apart from buying, selling, and trading tokens, investors can also stake their digital coins. The Binance staking service was launched in December 2020 and allowed users to stake on proof-of-stake digital coins like the ETH.

Additionally, Binance supports DeFi staking. It accommodates different coins like DAI, Binance Coin (BNB), Tether (USDT), BTC, and Binance USD (BUSD). Investors have a wide variety of coins they can stake on when using the Binance staking service.

The table below shows some staking percentages available with the Binance staking service. Some of the percentages are based on lock staking, with a staking period ranging from 15 days to 365+ days.

Coinbase Staking

Coinbase is a cryptocurrency exchange platform that accepts users worldwide despite being a US-based cryptocurrency exchange platform. It is listed on the NASDAQ and has various cryptocurrency assets ranging from the most popular coins like BTC and ETH. Apart from exchanging coins, users can also buy and sell their digital tokens for other tokens or fiat currency.

Coinbase staking allows investors to stake their tokens and get rewards at the end of the staking period. The platform supports the staking of various digital coins ranging from ETH 2.0, ALGO to XTZ.

The staking rewards at OKEx vary depending on the terms of staking. The platform has two staking options, flexible and fixed staking.

How to Pick the Best Cryptocurrency Staking Platform

Before you decide to stake your coins, it’s important to ensure the staking platform is the best. With many options in the market, picking the most profitable staking platform can be challenging. Investors who make the wrong choice risk losing their coins and even their rewards. When looking for the most beneficial, secure, and reliable staking platform, consider the following key tips:

Reviews from cryptocurrency investors and traders:

Analyzing the new DeFi platforms, don’t focus mainly on what the team and the founders claim to offer. If you are a non-tech person, you might not fully understand the protocol they are introducing and whether it will benefit you. Instead, look for reviews from various experts concerning the new platform. Dev users can easily spot possible rug pulls and alert users to a potential code vulnerability or foul play.

Annual Rewards:

While many people might be attracted to platforms showing high rewards, this shouldn’t be the main factor to consider. The APYs and annualized rewards are based on a lot of factors. They are not the only factor determining a staking platform’s credibility. Look at the reputation and credibility of the platform before staking your tokens, especially with the new staking platforms.

Reputability:

Always go for reputable staking platforms. You can check online and find the rating of the various staking platforms. Depending on your taking needs, your most preferred staking platform should be equipped with the best security and protocols for staking. Avoid fishy-looking staking platforms that promise users very high staking rewards.

Research: there are plenty of reliable analytics which provide users with important information about various staking platforms. Analytics platforms like CoinMarketCap have information on most of the PoS-based staking platforms. When researching cryptocurrency staking, it’s important also to explore the best coins, third-party staking services, and the best staking strategies.

Terms and Conditions:

Before signing up on any platform, it’s important to read the fine print. The terms and conditions will determine how you stake, the size of the reward, and how you can access your rewards. These rules govern the whole staking process. If you don’t understand some of the terms and conditions, you can always inquire on various platforms like Reddit and Twitter and get feedback from more experienced cryptocurrency stakers.

Cryptocurrency Staking Pros

- An easy and simple way of generating additional income for passive cryptocurrency investors.

- User-friendly for novice cryptocurrency enthusiasts if implemented through third-party services or exchange platforms.

- It is more environmentally friendly and energy-efficient.

- It has higher returns than interest and low risk compared to cryptocurrency trading.

Cryptocurrency Staking Cons

- It can incur fees when done through third-party services and staking platforms.

- The value of the token will greatly impact the staking rewards.

- Investors lack easy and unlimited access to their tokens hence lack investing opportunities.

Risks of Cryptocurrency Staking

Cryptocurrency investors will all have one key question. Is cryptocurrency staking safe? Staking tokens comes with the following risks:

- Cyber-attacks: Like other online platforms, third-party staking services and staking platforms are at risk of hacking or cyber-attacks. With this concern, some investors prefer staking on hardware cryptocurrency wallets.

- Coin value falls: the cryptocurrency market is volatile. When staking, investors can’t liquidate their holdings should the market price of the coin start dropping.

- Penalty: the validator nodes holding the staked coins risk being penalized should they not have 100% of the staking period.

The Future of Cryptocurrency Staking

Cryptocurrency staking has been embraced as a much better option compared to PoW-based mining. Thanks to less energy consumption, the process is environmentally friendly and more economical. Cryptocurrency staking gained immense popularity in December 2020, when Ethereum embraced it. In 2023 there was a significant increase in decentralized and centralized coins staking as DeFi flourished.

Investors should be extra cautious with DeFi staking, especially with the many newly-created protocols that promise suspiciously high rewards. Cryptocurrency staking comes with plenty of risks; hence it’s important to research well and develop the best staking strategies before investing your hard-earned tokens.

Conclusion

If you are a holder of cryptocurrency tokens and don’t actively participate in trading, you should consider staking. Staking cryptocurrency is a simple way of generating passive income from your tokens. Instead of leaving your tokens in your digital wallet waiting for the market price to go up, you can be earning additional rewards from them through staking.

Staking cryptocurrency operates the same way as earning interest on your savings or earning dividends on your stock holdings. Like these two key examples, cryptocurrency staking comes with its own set of risks, pros and cons. When you decide to participate in cryptocurrency staking, you allow your tokens to be used in blockchain validation within the Proof of Stake blockchain network. After successful validation, you will be rewarded by the blockchain network.

While staking opens a new avenue for passive investors in the digital currency sector, investors must implement maximum precautions. If you are engaging in the staking of digital coins for the first time, you need to ensure you have the best staking strategy, using the safest and most reliable staking platforms. Additionally, all investors should balance and diversify their staking portfolio to get the highest returns from their stakes.